Audit of regular annual financial statements is mandatory for:

- large and medium sized companies,

- public companies (as defined by Law on Capital Market) regardless of their size,

- all legal entities whose operating income from the preceding business year exceeds EUR 4,400,000 in dinar equivalent and

- parent companies that prepare consolidated financial statements, that is legal entities that have control of one or more legal entities.

The deadline for signing an engagement letter for audit of financial statements for 2016 is:

- 30 September 2016 (for legal entities whose business year is the same as the calendar year);

- three months before end of business year to which the audit is related (for legal entities whose business year is different from the calendar year).

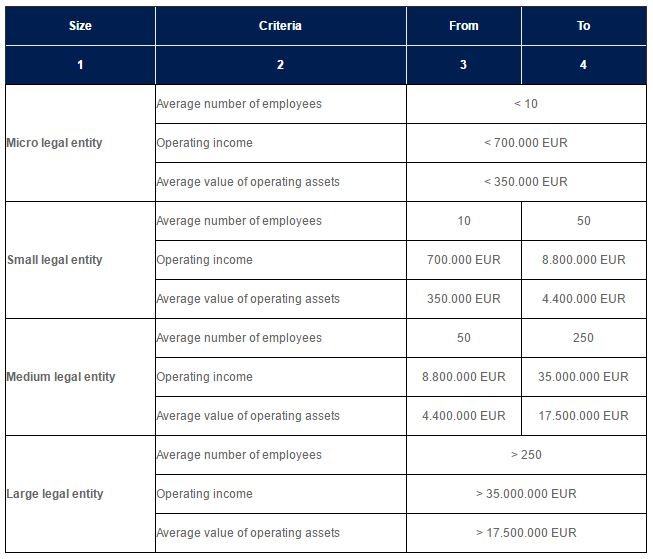

Legal entities are classified depending on the

- average number of employees,

- operating income and

- average value of operating assets

Legal entities shall be classified as micro entities if they do not exceed two criteria listed in column 4 of the table.

- Legal entities shall be classified as small and medium entities if they exceed two criteria listed in column 3 of the table, but do not exceed two criteria listed in column 4 of the table.

- Legal entities shall be classified as large entities if they exceed two criteria listed in column 3 of the table.

Newly established legal entities shall be classified on the basis of data from financial statements for the year in which they were established and the number of months in business, and determined data shall be used for that and the following financial year.

In accordance with the Law on Accounting, the following legal entities are considered to be large legal entities:

- the National Bank of Serbia (NBS),

- banks and other financial institutions supervised by the NBS,

- insurance companies,

- financial leasing providers,

- voluntary pension funds,

- companies managing voluntary pension funds,

- open- and closed-ended investment funds,

- investment funds’ management companies,

- stock exchanges and broker-dealer companies,

- factoring companies.